#1. The Beat of the Monetisation Drum Grows Louder

If the first major VOD product cycle (2006 – 2011) was about getting MVPs to market and the second, circa 2012 – 2015, saw broadcasters ditching some of their legacy systems in favour of external vendor solutions, the third was when boards of directors all over the world were hoping that on-demand services would start paying for themselves via advertising and subscriptions.

Has that happened? Well, it’s a mixed picture. Certainly, in mature markets like the UK, Northern Europe and North America, digital revenues are climbing (for example, the UK’s biggest commercial broadcaster, ITV, posted a rise in “online, pay and interactive” income of £60m between 2015 and 2017; in Europe, RTL Group saw its digital revenues more than double from 295m to 670m Euros between 2014 and 2016). The problem is that linear ad revenues have, on average, fallen by 8% in those territories during the same period and digital isn’t plugging the gap quickly enough.

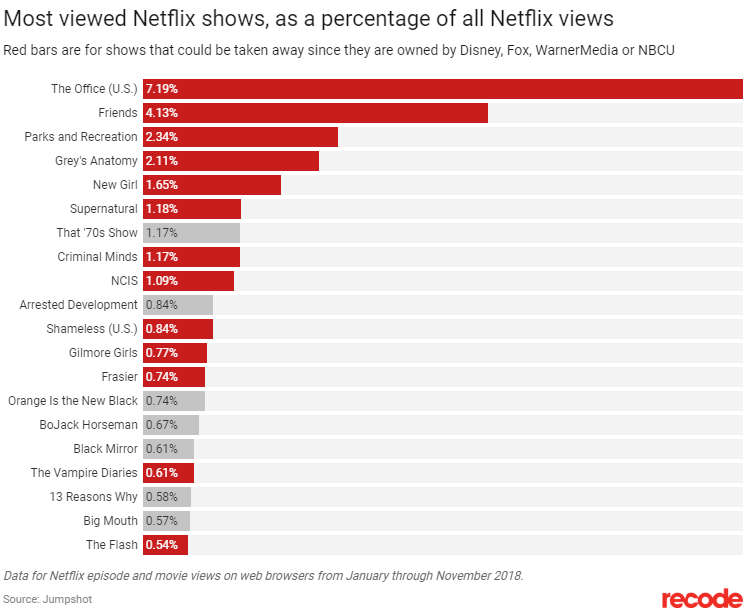

At the same time, premium content – which services need to encourage advertisers and subscriptions – is costing more. Netflix recently paid WarnerBros $100m to renew Friends for another year and analysis suggests that in the US, the company only fully controls the rights to two of its twenty most popular shows in the US.

The fourth big VOD product cycle kicked off last year and as the beat of the monetisation drum grows louder – and more frequent – over the next 12 – 36 months, expect VOD services to race to grapple with these challenges.

#2. The Return of the Set-Top Box

The demise of set-top boxes has been predicted every year since I started working in online television in 2005 and for a variety of good reasons. Development, rollout and maintenance costs were too high (YouView cost £70m to bring to market; Sky Q, over £100m), greater bandwidth and device capabilities would lead to more reliable OTT streaming and Cloud storage would enable network DVRs which would, in turn, make PVRs redundant.

And yet, set-top boxes are thriving. Liberty Global recently released its next-gen European platform, Horizon 4; Sky Q is now being used in 2.5 million British homes and Amazon, with its Fire Stick, and Roku dominate market share for streaming players in the US. Form factors have changed, wholesale unit prices for operators are decreasing (Kai Borchers, the MD of 3SS – a vendor that specialises in Android TV on set-top boxes – told me that dongles and “pucks” can now be bought for around $15 and $30 respectively) and new use cases like IOT and the Smart Home mean that STBs are going to be with us for some time yet.

#3. Global Entertainment Spend and SVOD Price Elasticity

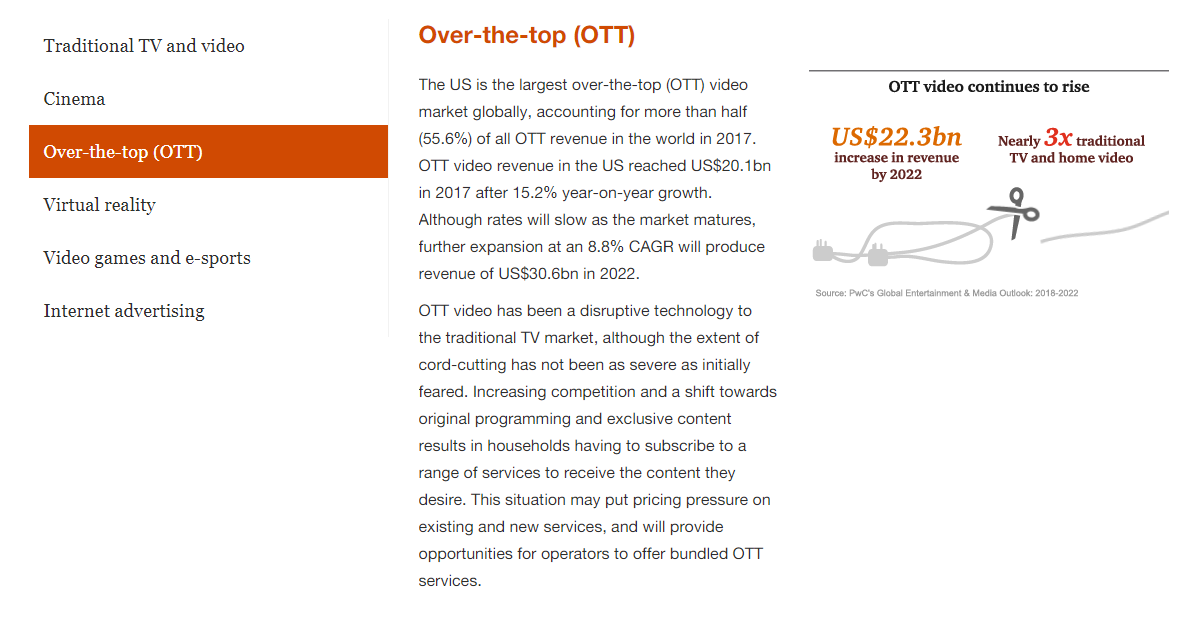

In its 2018 Global Entertainment & Media Outlook report, PWC forecast that global entertainment revenues would climb from $1.9 trillion in 2017 to $2.4 trillion in 2022 (a compound annual growth rate of 4.4% over the period). As a subset of that, OTT revenue would reach $58bn by 2022 and grow at a rate of 10% YOY. The company also predicted that US OTT spending would double over 5 years to $30bn, China (the second-largest market) would grow at a 16% CAGR through 2022 and (wow!) TVOD would account for $10bn revenues in 2022 (an 8% CAGR).

Clearly, consumers are increasing what they’re willing to spend on entertainment and VOD, as a sector, is benefitting (only VR will grow at a faster rate says PWC). What will really be interesting is to see exactly how much elasticity there is in people’s budgets. With Netflix raising its prices from £5.99 a month (in the UK) at launch in 2012 to £7.99 a month last year (£9.99 for UHD and four simultaneous-screen access), Amazon Prime upping the quality and quantity of its content catalogue (augmented by premium sports rights), and both Apple and Disney launching new on-demand services this year, we may get a sense of how much value viewers place on continuing to subscribe to individual offerings. Talking of which…

#4. The Streaming Game of Thrones: Netflix, Amazon, Disney, Apple and other Dragons

Whilst the threat posed to OTT video by VR isn’t insubstantial (in an interview with Wired UK magazine in 2015, Reed Hastings, with the deliberate insouciance of a man whose estranged partner has an upcoming date with Chris Hemsworth, referred to virtual reality only as “a worry”), let’s assume that a full-on Matrix-style, immersive, opioid experience is at least fifteen years away. Who, in the meantime, wins the Streaming Game of Thrones?

The incumbent, Netflix, has challenges to overcome. To counter the twin threats from Amazon and Disney (to which it’s about to lose Marvel rights), it recently increased its annual content budget to $12bn making its net debt $8.3bn at the end of September 2018, up 70% YOY. Netflix’s share price has plummeted from a high of $418 as recently as July 2018 to $234 on Christmas Eve, its core domestic market is almost saturated and there are rumours that Hastings himself will be replaced as CEO. Look out for the company’s next earnings call on January the 17th.

Apple’s new VOD service, due to launch this year, is apparently the good guy in this scenario: it will, reportedly, be family-friendly and avoid “producing any television content with gratuitous sex, violence or profanity”. It has widespread consumer device penetration, instilled loyalty and the finances to buy anyone it wants. If Apple is the Jon Snow, could Sony, with its own extensive rights catalogue, worldwide footprint, production infrastructure as well as name, hardware and cachet, be the Daenerys Targaryen? Either way, and to stretch the metaphor one more time, Google / YouTube, with its ability to turn almost anyone with a smartphone or an email account into a customer, is definitely the Night King here.

#5. Vendor Outlook: Upcoming Projects and More M&A and Funding Rounds

Increasing commoditisation, the maturity of broadcaster VOD services, a concomitant fall in CAPEX spending and a greater focus on direct and indirect monetisation all mean that this could be a challenging year for some of the technology vendors in our space. At the same time, there are still plenty of projects for suppliers to bid for including:

- New stand-alone D2C services

- UI / UX upgrades

- New content recommendation and personalisation functionality

- VOD and Broadcast infrastructure convergence

- The shift from broadcast to IP delivery especially, over the next three years, for European public service broadcasters

- Storage and content distribution

- Analytics and CRM (to help with monetisation)

- AI development (see below)

- Emerging markets (territorially and vertically)

- STB development (as outlined above)

- And related security and conditional access solutions

With MediaKind being carved out of Ericsson last year, Velocix forming out of Nokia’s IP video business, Massive and W12 being bought by Deltatre and Tata, Accedo announcing, just last week, that it had raised 17m Euros in a new funding round, Sky / Comcast having taken a stake in Synamedia yesterday and, hot off the presses, RTL acquiring Yospace, we’ll likely see a lot more M&A and consolidation in 2019.

#6. Sports OTT Services Continue to Gather Pace

If you’re a regular VOD Pro visitor you’ll know that we’ve built a resource called the VUIX Library in which we track over 500 VOD products, across platforms, from all over the world. We analyse their user interfaces, produce video walk-throughs and have incorporated over 3 million end-user reviews from the iTunes and Google Play app stores.

Ok, so massive plug aside, the reason I mention this is because specialist Sports OTT services seem to have suddenly multiplied over the past couple of years. DAZN, for example (which is part of the Perform Group), has a portfolio which includes the English Premier League and La Liga football as well as the NFL and NBA. Eleven Sports (which, admittedly, may not be around for much longer) shows football and had negotiated some Ultimate Fighting Championship rights. And GOLFTV, from Discovery, is set to go live this month after having announced a partnership with the European Tour.

With potential new offerings on the cards from UEFA and WWE, Amazon’s three-year tenure of some English Premier League football starting in August, the Sportel conference in Monaco going great guns and suppliers like Simplestream responding by launching dedicated sports VOD solutions (see also Accedo, Deltatre, Grabyo, StreamUK, TiVo), Sports OTT will be big in 2019.

#7. What Next for BBC iPlayer?

In a speech at the Royal Television Society last September, the BBC’s Director-General, Tony Hall, told his audience that in responding to the challenge of service-providers like Amazon and Netflix, the corporation’s aim was to make BBC iPlayer more of a “destination” than a catch-up service. How will it do that?

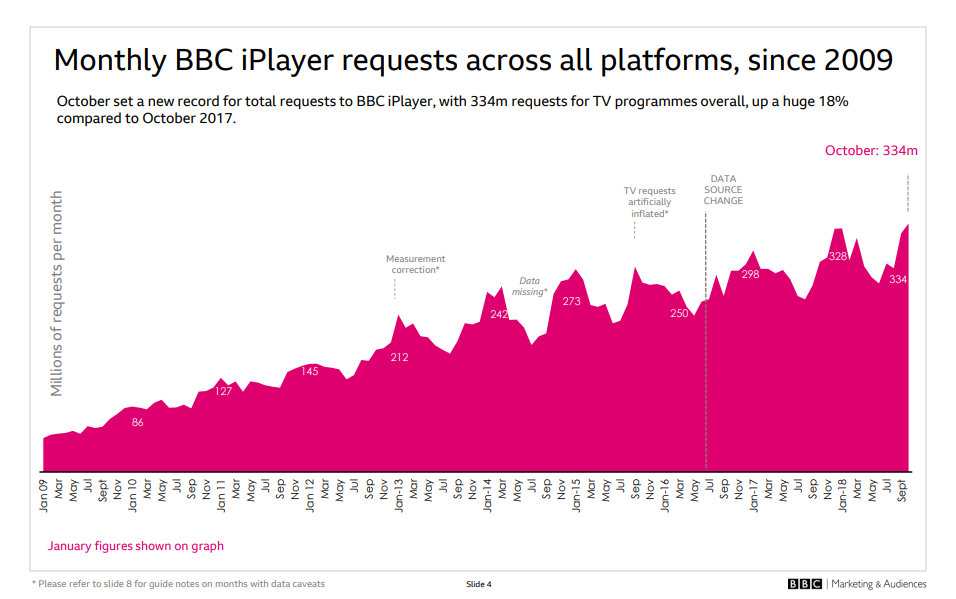

Hall cited the need to “keep reinventing our services” and investing more in content for children and young people. Further plans will, no doubt, be announced in due course, but right now, iPlayer is still growing (the service reported its best-ever monthly numbers in October 2018 – 334 million TV requests, up 18% on the same month last year), it’s UI, across platforms, is steadily improving in terms of features and functionality and more content, in the form of drama and comedy box sets (99 of them as at the beginning of January), than ever before is available through the service.

Things seem to be going well but if iPlayer is to truly become a long-term go-to for viewers, expect to see more innovation and acceleration in how it evolves this year.

#8. Will Broadcaster Brands become Invisible?

It’s a myth, a TV exec told me last year, that Millennials and Gen Zs / Alphas don’t have any loyalty to brands. They follow brands that represent their values, that tell stories, that listen to them and become trusted. They talk about these brands, sometimes fanatically, on their preferred social media networks using devices that they proprioceptively think of as extensions of their own limbs. Loyalty is everywhere if broadcasters (including him, he admitted) just knew how to harness it, he said.

It’s a conundrum that TV companies, all over the world, are facing – how to keep their channel brands relevant. In the same way that those of us who are, say, over 35, didn’t usually think about who the production company was for a programme we were watching when we were kids, our own children are growing up not being able to name-check the broadcaster. Their recognition is of the TV show brand itself, the aggregator (Amazon, Netflix, Sky etc.) and to their screen manufacturer.

How to solve it? Greater use of personalisation, content recommendation, innovative marketing, AI and better communication will all help but ultimately, do broadcasters need to get comfortable with the idea that their brands will effectively become invisible over the next few years?

#9. More AI in TV and VOD Services

Are you deploying artificial intelligence in your TV and VOD services yet? If not, and if not in 2019, it’s something we’ll all increasingly be doing over the next few years. The AI use cases for our industry are burgeoning and include:

- Better content discovery and recommendation

- Creating automated highlights packages (e.g. IBM’s work with Wimbledon)

- Improving subtitles / captions

- Using data points (like how much of a show a viewer watches, when they turn the volume up or down, when and on what devices they open a TV guide etc.) to create better, more personalised user experiences

- Powering data overlays and preferred camera angles (particularly useful when watching sport)

- Better “hearing”, comprehension and execution of voice commands

- Improving the efficiency and scope of backend tasks like ingest, encoding, metadata and workflow

I anticipate writing a lot about AI this year so if you’re working on an AI solution or project, please do drop me a line. For now, some interesting companies to talk to in this space are Dativa, IBM and ThinkAnalytics.

#10. The Beginning of the 5G Rollout

5G is finally here – almost. 2019 will see the new network start its rollout in earnest across South Korea, Japan, China, the US and some parts of Northern Europe and as it becomes more widespread and reliable, with it will arrive changes to both business revenues and consumer behaviour.

For triple and quad-play providers, two of their long-standing income streams – monthly landline and related broadband – will begin to diminish. That’s not unexpected: asked last November if he thought that 5G would let user get rid of their fixed-line home broadband, David Dyson, Three’s UK Chief Executive, said,

“Maybe not for the whole country, but certainly [for] a significant majority of the country, I strongly believe 5G can offer a good enough home broadband experience for people to effectively ditch their copper [or fibre] connection,“.

One of the knock-on effects, however, will be the ability of operators to continue current spending on premium content. With fewer customers and lower revenues, will Sky and BT, for example, still be able to bid for (and expect to win) English Premier League rights?

For VOD users, reliable 5G will fuel the next stage of the TV revolution: in theory, 5G could offer download speeds of up to 20Gbps which would enable true 4 / 8K streaming to mobile devices, real-time data overlays on multiple camera viewpoints and other enhanced AR functionality.

To paraphrase HG Wells, I, for one, look forward to welcoming our new 5G overlords.

Happy 2019!

ABOUT KAUSER KANJI

Kauser Kanji has been working in online video for 19 years, formerly at Virgin Media, ITN and NBC Universal, and founded VOD Professional in 2011. He has since completed major OTT projects for, amongst others, A+E Networks, the BBC, BBC Studios, Channel 4, DR (Denmark), Liberty Global, Netflix, Sony Pictures, the Swiss Broadcasting Corporation and UKTV. He now writes industry analyses, hosts an online debate show, OTT Question Time, as well as its in-person sister event, OTT Question Time Live.